On Thursday, the 15th of October 2020, China’s finance ministry sold US dollar debt directly to US buyers for the first time, with a $6bn offering drawing a record demand of more than $27bn, or roughly $10bn more than an offering of the same size last year. According to the Financial Times, “the Chinese government’s move just weeks before Americans head to the polls for the presidential election shows how tightly the financial systems of the two countries are linked, despite a trade war and tensions over technology and geopolitics.” The bonds sold by China’s finance ministry on Thursday drew orders worth more than $27bn, or roughly $10bn more than an offering of the same size last year, according to bankers on the deal.

“Bankers involved in the bond sale said US demand was strong, with about 15 percent going to American investors. Investors were attracted in part by the Chinese bonds’ high yields compared to those issued by the US government. ‘The bond sales received a strong reception from US onshore real money investors’, said Samuel Fischer, head of China Onshore Debt Capital Markets at Deutsche Bank, which helped arrange the deal.”

The Wall Street Journal reported that “China’s four-part deal included bonds due in three, five, 10 and 30 years, according to a term sheet. The shortest dated was priced to yield 0.25 percentage point over corresponding U.S. Treasuries, while the bond due in 2050 offered an extra yield of 0.8 percentage points. China has solid investment-grade credit ratings, with an A-plus grade from S&P Global Ratings and an equivalent A1 from Moody’s Investors Service. Those ratings are in line with Japan’s.”

According to Bloomberg, “HSBC Holdings Plc was left off the list of banks arranging China’s sovereign dollar debt sale for the first time since the nation returned with big annual deals in 2017. The $6 billion sale was arranged by 13 banks, including four Chinese lenders and foreign banks such as Bank of America Corp., Citigroup Inc. and Standard Chartered Plc, according to people familiar with the matter who asked not to be named discussing a private information.”

“The reason for HSBC’s omission was unclear, but the London-based lender’s relationship with China has become increasingly fraught. The bank has been blasted by Chinese media for its role in the U.S. investigation of Huawei Technologies Co. and criticised for not coming out fast enough in support of Hong Kong’s new security law.”

In October of 2019, I initiated a discussion in Beijing to open the Chinese RMB bond market to foreign investors, which consequently led to a decision being made in January. Year-to-date, over $80 billion entered Chinese bond markets, which according to The Asset have “reached $14 trillion after rapid growth over the past two decades, making it the second largest fixed-income market in the world. Its low correlation to other global bond markets offers investors a good source of diversification, while the potential for relatively high risk-adjusted return makes it an attractive income generator in a world awash in negative yielding bonds.”

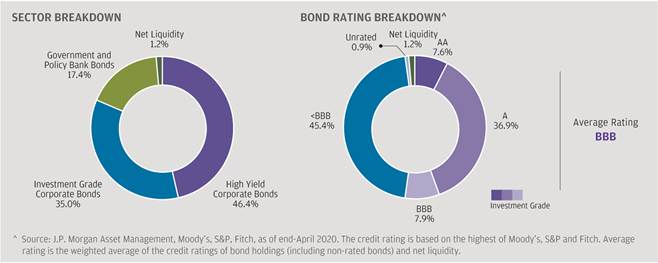

To provide diversified access to China’s vast fixed income market, J.P. Morgan Asset Management launched the JPMorgan Funds – China Bond Opportunities Fund earlier this year.

“The current low or even zero interest rate environment across developed markets has made it more challenging for investors to find yield opportunities, making the income potential of China bonds more appealing.

‘The fund was designed and launched to meet this specific investor demand, seeking income flexibly across the entire China bond universe. The fund managers combine our top-down macroeconomic views and bottom-up fundamental research, with a focus on picking quality bonds,’ said Elisa Ng, head of China and Hong Kong Funds at J.P. Morgan Asset Management. The fund’s yield to maturity is 7.3% as of 30 April 2020 and is available to international investors.”

FTSE Russell said on September 24th that they would add Chinese government bonds to its flagship World Government Bond Index from October next year. According to CNBC, “this will be China’s third entry into a major global bond index and comes at a time when investors are hunting for yield in an environment of ultra-low interest rates. Several investors estimated that at least $100 billion will flow into China after its bonds debut on the FTSE Russell index.”

Compared with the Chinese USD bond, the first €17bn of bonds under the EU’s €100bn SURE programme, which came with 10-year and 20-year maturities and the new 10-year bond priced at a yield of minus 0.26 per cent. Despite the negative yield, that is substantially higher than the yield of minus 0.62 per cent offered by a 10-year German bond, which serves as the Eurozone’s benchmark safe asset.

It’s interesting to see Beijing moving to issue a USD bond while all RMB bonds are attracting enough inflow of hard currencies, thus raising the question about possible geo-politic motives.

On October 6th, in a declaration drafted by Germany and presented at the UN General Assembly in New York, 39 predominantly Western countries denounced China for gross human rights violations in the western Chinese province of Xinjiang and the autonomous region of Tibet, and for limiting political and personal freedoms in Hong Kong.

In a statement endorsed by the UK, the US and many EU countries, Germany’s ambassador to the UN, Christoph Heusgen, drew attention to “widespread surveillance [that] disproportionately continues to target Uighur and other minorities” as well as “forced labor and forced birth control including sterilisation.” Regarding Hong Kong, the German ambassador expressed “deep concerns” about elements of the recently enacted national security law, which allow for certain cases to be transferred for prosecution to mainland China. China’s ambassador to the UN, Zhang Jun, responded with a statement, saying the accusations were “groundless” and that his country “opposes interference in internal affairs.” In separate statements, Pakistan and Cuba voiced their support for Beijing’s position, as did a group of mainly African and Arab countries, Russia and Venezuela.

To Beijing, this German initiative has again proven the strategic importance of sustaining economic ties with the US, and US dollar dominance. As long as the Euro is a politically unreliable alternative, the US dollar will remain a must for the foreseeable future.

China’s signal to Wall Street and US dollar dominance is also a message to all stakeholders in Chinese interests in Europe: China will never compromise its economic interests strategically due to ideological disputes; politically, China seeks common ground while preserving differences. It will always support long-term partners facing a difficult time. As for the companies that choose to betray Chinese customers: China knows them well and has a long memory.

While China is beginning to get rid of dependence on ore and coal imports from Australia, the US dollar bond issuance is a reminder to London, Brussels and Berlin: We are committed to economic and financial openness, because of our own strength; economic interests strategically dominate our decision-making; our policies serve fundamental development needs.

Economic interests have never been, shall never and will never be an either-or choice for Beijing. Now, given the ongoing pandemic chaos in the US, it is time for China to defend USD. Current political confusion in Germany regarding China means that, for Beijing, a strategic economic decision in favour of either the EU or USA is simply non-existent.